"Future of Executive Summary Accidental Damage Insurance Market: Size and Share Dynamics

CAGR Value

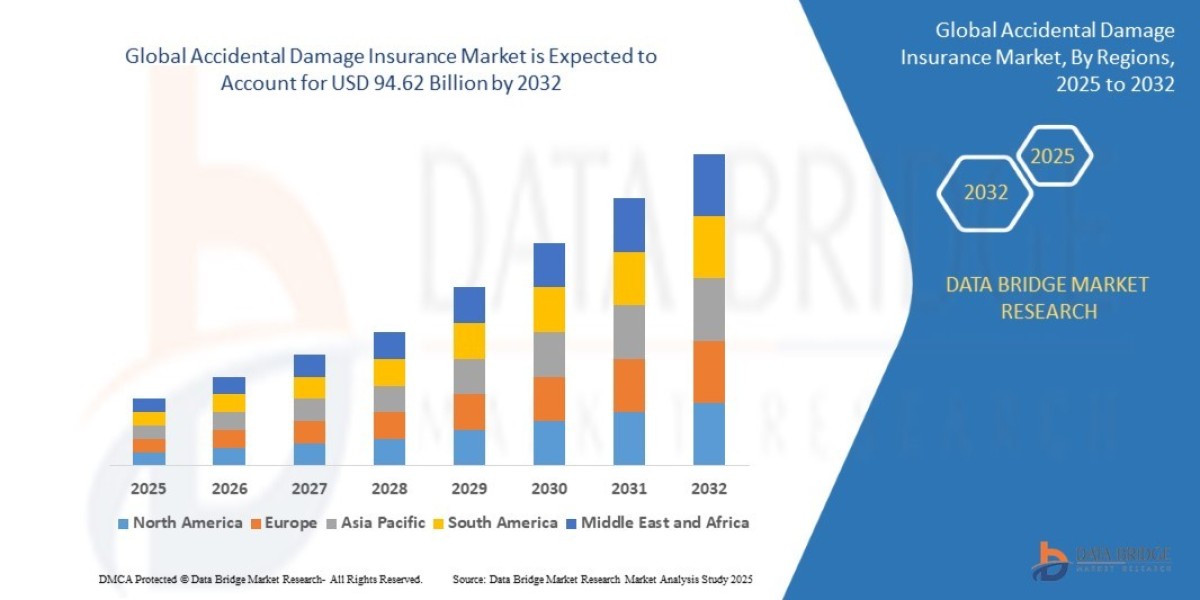

The global accidental damage insurance market size was valued at USD 71.3 billion in 2024 and is projected to reach USD 94.62 billion by 2032, with a CAGR of 3.60% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Accidental Damage Insurance Market research report is a sure solution to get market insights with which business can visualize market place clearly and thereby take important decisions for growth of the business. By getting an inspiration from the marketing strategies of rivals, businesses can set up inventive ideas and striking sales targets which in turn make them achieve competitive advantage over its competitors. Accidental Damage Insurance Market report inspects the market with respect to general market conditions, market improvement, market scenarios, development, cost and profit of the specified market regions, position and comparative pricing between major players.

An influential Accidental Damage Insurance Market report conducts study of market drivers, market restraints, opportunities and challenges underneath market overview which provides valuable insights to businesses for taking right moves. This market report is a source of information about Accidental Damage Insurance Market industry which puts forth current and upcoming technical and financial details of the industry to 2029. The report is a window to the Accidental Damage Insurance Market industry which defines properly what market definition, classifications, applications, engagements and market trends are. Moreover, market restraints, brand positioning, and customer behavior, is also studied with which achieving a success in the competitive marketplace is simplified.

Tap into future trends and opportunities shaping the Accidental Damage Insurance Market. Download the complete report:

https://www.databridgemarketresearch.com/reports/global-accidental-damage-insurance-market

Accidental Damage Insurance Market Environment

**Segments**

- **Insurance Type**: The accidental damage insurance market can be segmented based on the type of insurance offered, such as home insurance, auto insurance, electronics insurance, and others. These segments cater to different needs of consumers looking to protect their assets from accidental damage.

- **Distribution Channel**: Another key segmentation in the market is based on distribution channels, including online channels, direct sales, insurance agents, and others. The availability of multiple distribution channels allows insurance providers to reach a wider customer base.

- **End-User**: The market can also be segmented by end-users, such as individuals and businesses. Businesses may require specialized accidental damage insurance coverage for their assets, while individuals may seek protection for personal belongings.

**Market Players**

- **Allianz**: Allianz is a prominent player in the global accidental damage insurance market, offering a wide range of insurance products for individuals and businesses. The company's reputation for reliability and coverage options has helped establish its position in the market.

- **AXA**: AXA is another key player in the market, known for its diverse insurance portfolio and global presence. The company's innovative insurance solutions cater to the evolving needs of consumers, enhancing its competitiveness in the market.

- **Zurich Insurance Group**: Zurich Insurance Group is a leading provider of accidental damage insurance, with a focus on risk management and tailored solutions. The company's strong financial standing and customer-centric approach set it apart in the market.

- **State Farm**: State Farm is a prominent player in the U.S. accidental damage insurance market, known for its personalized service and comprehensive coverage options. The company's extensive network of agents adds to its competitive edge in the market.

The global accidental damage insurance market is experiencing steady growth, driven by increasing awareness about the benefits of insurance coverage against unforeseen events. The demand for different types of accidental damage insurance, such as home, auto, and electronics insurance, is fueling market expansion. Additionally, the availability of multiple distribution channels, including online platforms and insurance agents, is making it easier for consumers to access insurance products tailored to their needs. End-users, including individuals and businesses, are increasingly recognizing the importance of protecting their assets from accidental damage, further driving market growth.

Key market players, such as Allianz, AXA, Zurich Insurance Group, and State Farm, are at the forefront of the global accidental damage insurance market. These companies offer a diverse range of insurance products and services, leveraging their expertise and customer-centric approach to gain a competitive advantage. By focusing on innovation, risk management, and personalized solutions, these market players continue to strengthen their positions and meet the evolving needs of consumers. Overall, the global accidental damage insurance market is poised for continued growth, with key players driving innovation and expanding their market presence.

The global accidental damage insurance market is witnessing a shift towards more customized and flexible insurance products to meet the diverse needs of consumers. One emerging trend in the market is the integration of technology, such as artificial intelligence and data analytics, to enhance risk assessment and streamline claims processing. Insurance providers are leveraging digital platforms to offer seamless customer experiences and improve operational efficiency. This digital transformation is not only increasing customer engagement but also enabling insurers to better understand consumer behavior and preferences, leading to more targeted and relevant insurance offerings.

Moreover, sustainability and environmental considerations are also becoming increasingly important drivers in the accidental damage insurance market. With the growing awareness of climate change and environmental risks, consumers are seeking insurance solutions that provide protection against natural disasters and environmental damage. Insurance companies are responding to this trend by developing innovative products that cover a wider range of environmental risks, such as floods, wildfires, and hurricanes. By incorporating sustainability principles into their insurance offerings, insurers can attract environmentally conscious customers and differentiate themselves in the competitive market landscape.

Another significant development in the accidental damage insurance market is the rise of parametric insurance products. Parametric insurance uses predefined criteria, such as seismic activity or rainfall levels, to trigger automatic payouts without the need for traditional claims processing. This type of insurance offers faster claim settlements and greater transparency, providing consumers with quick financial relief in the event of an insured incident. The adoption of parametric insurance is expected to increase as consumers seek more efficient and responsive insurance solutions that mitigate financial risks associated with accidental damage.

Furthermore, regulatory changes and evolving legal frameworks are shaping the landscape of the accidental damage insurance market. Insurers are adapting to new regulatory requirements and compliance standards, which can impact product offerings, pricing strategies, and distribution channels. In response to regulatory shifts, insurance companies are investing in robust risk management practices and governance structures to ensure compliance and uphold industry standards. By staying abreast of regulatory developments and implementing best practices, insurance providers can build trust with customers and maintain a competitive edge in the market.

In conclusion, the global accidental damage insurance market is undergoing significant transformations driven by technological advancements, environmental considerations, the rise of parametric insurance, and regulatory influences. Insurers that embrace these trends and innovate their product portfolios accordingly will be well-positioned to capitalize on the growing demand for tailored insurance solutions. By prioritizing customer-centric approaches, embracing digitalization, and staying agile in response to market dynamics, insurance companies can navigate the evolving landscape of accidental damage insurance and drive sustainable growth in the long term.The accidental damage insurance market is continually evolving, driven by various factors that are reshaping the industry landscape. One key trend is the increasing customization and flexibility of insurance products to meet the diverse needs of consumers. As market players seek to differentiate themselves, they are offering more tailored solutions that cater to specific customer requirements. This trend is helping to enhance customer satisfaction and loyalty, as individuals and businesses can now choose insurance coverage that aligns closely with their needs and preferences.

Moreover, the integration of technology, such as artificial intelligence and data analytics, is revolutionizing how insurers assess risks and process claims. By leveraging advanced technologies, insurance providers are streamlining their operations and improving the overall customer experience. This shift towards digital transformation is not only enhancing operational efficiency but also enabling insurers to develop more insights into consumer behavior, enabling them to offer more targeted and relevant products.

Another notable trend in the accidental damage insurance market is the increasing focus on sustainability and environmental considerations. With growing concerns about climate change and environmental risks, consumers are placing greater importance on insurance solutions that provide protection against natural disasters and ecological damage. Insurance companies are responding to this trend by developing innovative products that cover a wide range of environmental risks such as floods, wildfires, and hurricanes. By incorporating sustainability principles into their offerings, insurers can attract environmentally conscious customers and establish a competitive edge in the market.

Furthermore, the rise of parametric insurance products is transforming the industry by offering faster claim settlements and greater transparency. This type of insurance, which relies on predefined criteria to trigger automatic payouts, provides consumers with quick financial relief in the event of an insured incident. The adoption of parametric insurance is expected to grow as consumers increasingly demand more efficient and responsive insurance solutions that mitigate financial risks associated with accidental damage.

Additionally, regulatory changes and evolving legal frameworks are playing a significant role in shaping the accidental damage insurance market. Insurers must stay abreast of new regulatory requirements and compliance standards to adapt their product offerings, pricing strategies, and distribution channels. By investing in robust risk management practices and governance structures, insurance providers can ensure compliance and uphold industry standards, thereby building trust with customers and maintaining a competitive edge in the market.

In conclusion, the accidental damage insurance market is experiencing a period of significant transformation fueled by technological advancements, environmental considerations, the emergence of parametric insurance products, and regulatory influences. Insurers that can successfully navigate these trends, innovate their product portfolios, and prioritize customer-centric approaches are likely to thrive in a rapidly changing market environment. By embracing digitalization, sustainability principles, and regulatory best practices, insurance companies can position themselves for long-term success and sustainable growth in the evolving landscape of accidental damage insurance.

Evaluate the company’s influence on the market

https://www.databridgemarketresearch.com/reports/global-accidental-damage-insurance-market/companies

Forecast, Segmentation & Competitive Analysis Questions for Accidental Damage Insurance Market

- How large is the Accidental Damage Insurance Market currently?

- At what CAGR is the Accidental Damage Insurance Market projected to grow?

- What key segments are analyzed in the Accidental Damage Insurance Market report?

- Who are the top companies operating in the Accidental Damage Insurance Market?

- What notable products have been introduced recently in the Accidental Damage Insurance Market?

- What geographical data is included in the Accidental Damage Insurance Market analysis?

- Which region is experiencing the quickest growth in the Accidental Damage Insurance Market?

- Which country is forecasted to lead the Accidental Damage Insurance Market?

- What region currently holds the biggest share of the Accidental Damage Insurance Market?

- Which country is likely to show the highest growth rate in coming years?

Browse More Reports:

Global Vegan Protein Market

Asia-Pacific Heat Shrink Tubing Market

Global Plant-Based Cheese Market

Global Travel and Expense Management Software Market

Global Potting Compound Market

Global Bio-based Itaconic Acid Market

Global Amylin Analog Market

Global Fluorosurfactants Market

North America Ultrasound Devices Market

Global Flavored Spirits Market

Global Brain Positron Emission Tomography (PET) - Magnetic Resonance Imaging (MRI) Systems Market

Global Thermal Paper Market

Global Personal Computer (PC)-Based Automation Market

Europe Stroke Diagnostics Market

Global Chemical Seed Treatment Market

Global Prefabricated Building Systems Market

Global Energy Management at Workplace Market

Global Roll Forming Body in White Market

Europe Synchronous Condenser Market

Global Electrocoating (E-coat) Market

Middle East and Africa Paprika Powder Market

Global Urethral Discharge Syndrome Market

Middle East and Africa Amino Acid in Dietary Supplements Market

Global Angiography Devices Market

North America Anticoagulation Therapy Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"