"Executive Summary Theft Insurance Market Opportunities by Size and Share

CAGR Value

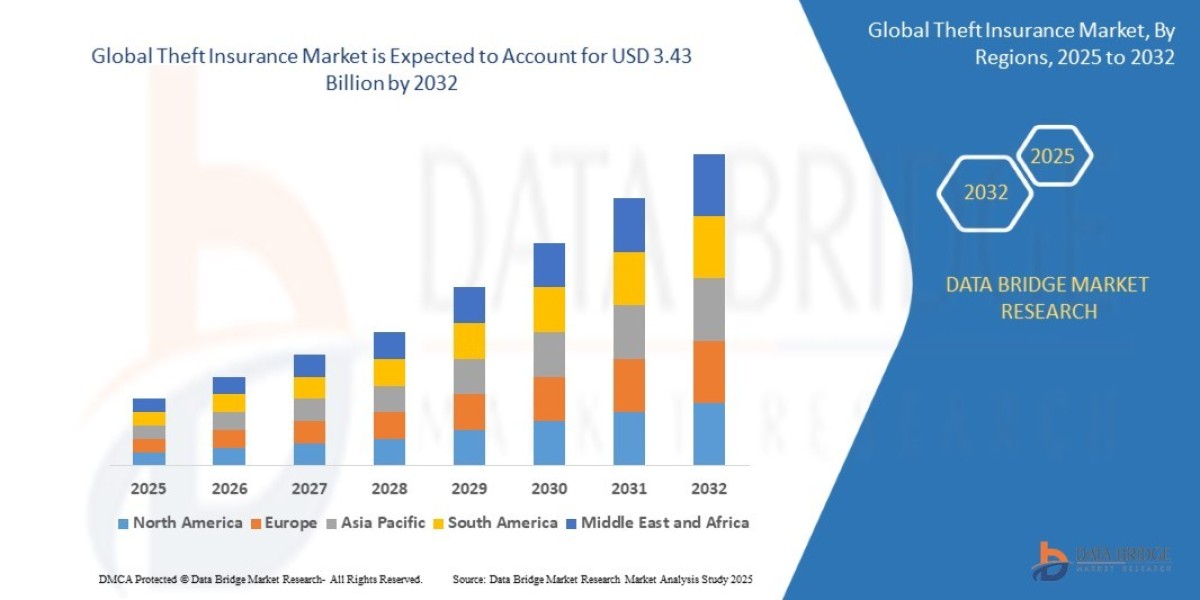

The global Theft Insurance market size was valued at USD 1.10 billion in 2024 and is projected to reach USD 3.43 billion by 2032, with a CAGR of 15.30% during the forecast period of 2025 to 2032.

An international Theft Insurance Market report lends a hand to identify how the market is going to perform in the forecast years by providing information about market definition, classifications, applications, and engagements. A complete discussion about numerous market related topics in this market research report is sure to aid the client in studying the market on competitive landscape. This market report spans different segments of the market analysis that today’s business demand. The data and information collected with the research is generally quite a huge and is also in a complex form. However, such intricate market insights are turned into simpler version with the help of proven tools and techniques to provide it to the end users.

As per the DBMR team predictions cited in the Theft Insurance Market report, the market will grow with a specific CAGR value in the forecast period of 2023 to 2030. By taking into account strategic profiling of key players in the Theft Insurance Market industry, comprehensively analyzing their core competencies, and their strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions, the report helps businesses improve their strategies to sell goods and services. The credible Theft Insurance Market report contains market insights and analysis for Theft Insurance Market industry which are backed up by SWOT analysis.

Analyze top trends and market forces impacting the Theft Insurance Market. Full report ready for download:

https://www.databridgemarketresearch.com/reports/global-theft-insurance-market

Current Scenario of the Theft Insurance Market

**Segments**

- **Coverage Type**: The theft insurance market is segmented based on the type of coverage offered by the insurance providers. These include property theft insurance, auto theft insurance, cyber theft insurance, and others. Each segment caters to different types of assets and risks associated with theft, providing a range of options for consumers to protect their assets against theft.

- **End-User**: Another key segmentation in the theft insurance market is based on the end-users of the insurance products. This includes individual consumers, small and medium-sized enterprises (SMEs), and large corporations. Different end-users have varying needs and requirements when it comes to theft insurance coverage, driving the demand for tailored insurance products in the market.

- **Distribution Channel**: The market for theft insurance is also segmented based on the distribution channels through which the insurance products are sold. These channels include insurance brokers, direct sales, online platforms, and others. The choice of distribution channel can impact the reach and accessibility of theft insurance products to consumers, influencing the overall market dynamics.

**Market Players**

- **Allianz**: Allianz is a prominent player in the global theft insurance market, offering a wide range of theft insurance products for individuals and businesses. The company's strong global presence and diverse product portfolio have positioned it as a key player in the market.

- **AXA**: AXA is another leading player in the theft insurance market, known for its innovative insurance solutions and customer-centric approach. The company's focus on digital transformation and customer experience has helped it maintain a competitive edge in the market.

- **State Farm**: State Farm is a well-established player in the theft insurance market, with a strong presence in the United States. The company's comprehensive theft insurance policies and personalized services have earned it a loyal customer base in the market.

- **Chubb Limited**: Chubb Limited is a global insurance provider with a significant presence in the theft insurance market. The company's focus on underwriting discipline and risk management has solidified its position as a trusted insurer for theft-related risks.

- **Zurich Insurance Group**: Zurich Insurance Group is a key player in the global theft insurance market, offering a wide range of theft insurance products to meet the needs of diverse customers. The company's strong financial performance and risk management practices make it a reliable choice for theft insurance coverage.

The theft insurance market is witnessing a significant shift towards more personalized and tailored insurance products to meet the evolving needs of consumers and businesses. One emerging trend in the market is the increasing demand for specialized theft insurance coverage, such as cyber theft insurance, as digital threats become more prevalent in today's interconnected world. Insurance providers are investing in technological advancements and data analytics to better assess and mitigate theft risks, offering innovative solutions to mitigate potential losses due to theft incidents. This focus on risk management and prevention is driving the development of new theft insurance products that provide comprehensive coverage against a wide range of theft scenarios.

Moreover, the market players in the theft insurance industry are also exploring strategic partnerships and collaborations to enhance their market presence and expand their product offerings. Partnerships with technology companies and cybersecurity experts are becoming increasingly common as insurance providers seek to leverage advanced technologies to improve their risk assessment capabilities and enhance customer experience. By combining expertise in theft insurance with cutting-edge technologies, market players can offer more robust and efficient solutions to address the evolving needs of consumers and businesses in an increasingly digital and interconnected world.

Furthermore, regulatory changes and evolving consumer preferences are shaping the competitive landscape of the theft insurance market. With increasing regulatory scrutiny on data protection and cybersecurity, insurance providers are required to comply with stringent regulations to ensure the security and privacy of customer data. This regulatory landscape presents both challenges and opportunities for market players, as they navigate complex compliance requirements while also leveraging regulatory changes to differentiate their offerings and gain a competitive advantage in the market.

In conclusion, the theft insurance market is experiencing dynamic changes driven by technological advancements, changing consumer preferences, and evolving regulatory environments. Market players like Allianz, AXA, State Farm, Chubb Limited, and Zurich Insurance Group are positioned to capitalize on these opportunities by offering innovative and tailored theft insurance products that address the diverse needs of consumers and businesses. As the market continues to evolve, collaboration, innovation, and regulatory compliance will be key drivers shaping the future growth and competitiveness of the theft insurance industry.The theft insurance market is a dynamic sector that is continuously evolving to meet the changing needs of consumers and businesses. One key trend in the market is the increasing demand for specialized theft insurance coverage, particularly in areas such as cyber theft insurance. With the rise of cyber threats in today's digital age, there is a growing recognition of the importance of protecting assets against digital theft incidents. Insurance providers are responding to this trend by developing innovative products that offer comprehensive coverage against a wide range of theft scenarios, including cyber theft.

Moreover, market players in the theft insurance industry are actively exploring strategic partnerships and collaborations to strengthen their market presence and expand their product offerings. By partnering with technology companies and cybersecurity experts, insurance providers can leverage advanced technologies to enhance their risk assessment capabilities and improve customer experience. These collaborations enable market players to offer more robust and efficient solutions that address the evolving needs of consumers and businesses in an increasingly digital and interconnected world.

Additionally, regulatory changes are playing a significant role in shaping the competitive landscape of the theft insurance market. With the increasing focus on data protection and cybersecurity regulations, insurance providers are required to adhere to stringent compliance requirements to ensure the security and privacy of customer data. This regulatory environment presents challenges for market players, but it also offers opportunities for differentiation and gaining a competitive edge by demonstrating commitment to regulatory compliance and data protection.

In conclusion, the theft insurance market is characterized by trends such as the demand for specialized coverage, strategic partnerships for technological advancements, and regulatory changes that influence market dynamics. Market players like Allianz, AXA, State Farm, Chubb Limited, and Zurich Insurance Group are well-positioned to navigate these trends and capitalize on opportunities for growth by offering innovative and tailored theft insurance products. The future of the theft insurance industry will likely be shaped by continued innovation, collaboration, and regulatory compliance to meet the evolving needs of consumers and businesses in a rapidly changing digital landscape.

Access segment-wise market share of the company

https://www.databridgemarketresearch.com/reports/global-theft-insurance-market/companies

Targeted Question Batches for Theft Insurance Market Exploration

- How is the Theft Insurance Market performing in current economic terms?

- What’s the outlook for market growth over the forecast window?

- How is the market structured by segment?

- Which brands have the largest footprint in the Theft Insurance Market ?

- What have been the most impactful recent product releases?

- Which regions and nations are assessed in the report?

- Where is the most dynamic market development occurring?

- Which country is predicted to lead the pack?

- What region holds a major stake in total revenue?

- What country has the most promising growth forecast?

Browse More Reports:

Global Automotive Pillars Market

Global Brain Aneurysm Market

Global Synchronous Condenser Market

Global Organic Maple Syrup Market

Global Fumed Silica Market

Global Garment Active Insulation Market

North America Low Carb Diet Market

Global Beauty Oils Market

Global Point of Care (POC) Drugs of Abuse Testing Market

North America Methotrexate Injection Market

Global Soy Isolates Market

Global Product Engineering Services Market

Global Atomic Layer Deposition Market

Global Sugar Substitutes in Food Industry Market

Global Electronic Design Automation (EDA) Tools in Integrated Circuits (IC) Industry Market

Global Airless Tires Market

North America Refinery catalyst Market

Global Geosynthetics Market

Global Polycythemia Vera Treatment Market

Asia-Pacific Dengue Treatment Market

Global Semiconductor Process Control Equipment Market

Global Pyogenic Granuloma Treatment Market

Middle East and Africa Magnet Wire Market

Middle East and Africa Multiple Hereditary Exostosis Market

Global Medium Density Fiberboard Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"