"Executive Summary Middle East and Africa Tax IT Software Market :

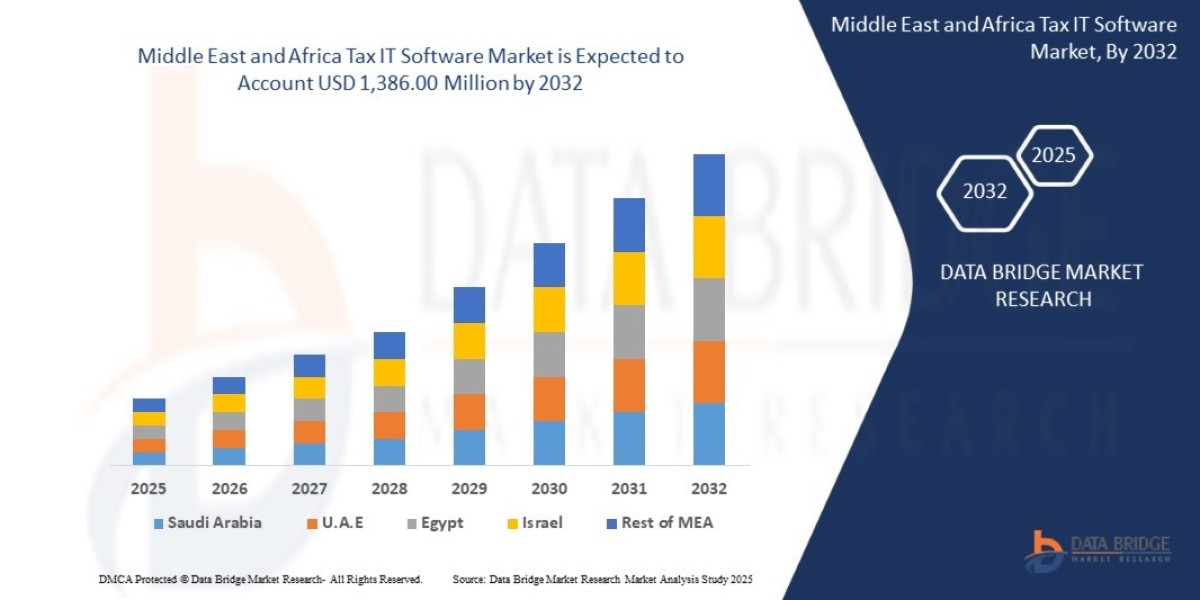

Data Bridge Market Research analyses that the tax the Middle East and Africa tax IT software market is expected to reach USD 1,386.00 million by 2032 from USD 855.75 million in 2024 growing with a CAGR of 8.1% in the forecast period of 2025 to 2032.

Middle East and Africa Tax IT Software Market research report, comprehensive analysis of the market structure along with forecast of the various segments and sub-segments of the industry can be obtained. It also includes the detailed profiles for the Middle East and Africa Tax IT Software Market’s major manufacturers and importers who are influencing the market. A range of key factors are analysed in the report, which will help the buyer in studying the industry. The report comprises of all the market shares and approaches of key players in market. Competitive landscape analysis is performed based on the prime manufacturers, trends, opportunities, marketing strategies analysis, market effect factor analysis and consumer needs by major regions, types, applications in global Middle East and Africa Tax IT Software Market considering the past, present and future state of the industry.

The Middle East and Africa Tax IT Software Market report provides an ideal window to the industry which explains what market definition, classifications, applications, engagements and market trends are. The report also recognizes and analyses the emerging trends along with major drivers, challenges and opportunities in the market. The report highlights CAGR value fluctuations during the forecast period for the market. The base year for calculation in the report is considered while the historic year which will tell you how the Middle East and Africa Tax IT Software Market is going to act upon in the forecast years by giving information about the several market insights.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Middle East and Africa Tax IT Software Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-tax-it-software-market

Middle East and Africa Tax IT Software Market Overview

**Segments**

- On the basis of component, the Middle East and Africa Tax IT Software market can be segmented into software and services. The software segment is expected to dominate the market as organizations are increasingly adopting tax IT solutions to streamline their tax operations and ensure compliance with ever-changing regulations. The services segment is also witnessing significant growth, driven by the demand for implementation, consulting, and support services to effectively integrate tax IT software into existing systems.

- By deployment type, the market can be categorized into on-premises and cloud-based solutions. The cloud-based deployment is gaining traction in the region due to its cost-effectiveness, scalability, and flexibility. Organizations are increasingly opting for cloud-based tax IT software to reduce upfront costs and enhance accessibility. On-premises deployments, on the other hand, continue to be popular among enterprises with specific security and compliance requirements.

- Based on organization size, the market can be divided into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are rapidly adopting tax IT software solutions to automate tax processes, improve efficiency, and minimize errors. Large enterprises, on the other hand, are investing in advanced tax IT software to manage complex tax structures, comply with regulations, and drive strategic decision-making.

**Market Players**

- Some of the key market players in the Middle East and Africa Tax IT Software market include Avalara, Bloomberg Tax & Accounting, CCH Incorporated, Sovos Compliance, and Thomson Reuters. These companies offer a wide range of tax IT software solutions tailored to the needs of organizations in the region. With the increasing focus on digital transformation and regulatory compliance, these market players are continuously innovating their offerings to stay competitive and address the evolving requirements of customers.

- Other notable players in the market include Vertex, Inc., Intuit Inc., Xero Limited, Sage Group plc, and Wolters Kluwer. These companies leverage advanced technologies such as artificial intelligence, machine learning, and automation to enhance the functionality and performance of their tax IT software solutions. By collaborating with tax authorities and industry associations, these market players are shaping the future of tax compliance and reporting in the Middle East and Africa region.

The Middle East and Africa Tax IT Software market is poised for significant growth and evolution as organizations across various industries increasingly recognize the importance of adopting digital solutions to effectively manage their tax operations. One emerging trend in the market is the integration of artificial intelligence (AI) and machine learning capabilities into tax IT software solutions. These advanced technologies enable more efficient data processing, predictive analytics for tax planning, and better compliance management. Market players are focusing on enhancing the intelligence and automation capabilities of their offerings to provide customers with more value and competitive advantages.

Another key aspect influencing the market is the shift towards more customizable and scalable tax IT software solutions. Businesses in the Middle East and Africa region are seeking software that can be tailored to their specific tax requirements while also being able to adapt to changing regulatory landscapes. Flexibility and agility have become crucial factors for organizations looking to future-proof their tax operations and stay ahead of compliance challenges. Market players are responding to this demand by offering modular solutions that can be customized to suit the unique needs of different businesses.

Furthermore, the increasing emphasis on data security and privacy is shaping the development of tax IT software in the Middle East and Africa market. With the rising concerns around cyber threats and data breaches, organizations are looking for solutions that provide robust security measures to safeguard sensitive tax information. Market players are investing in encryption technologies, secure cloud infrastructure, and compliance certifications to ensure the confidentiality and integrity of data processed through their software. Security and compliance have become differentiating factors for companies competing in the tax IT software market.

Moreover, collaborations and partnerships between tax IT software providers and government bodies are playing a significant role in driving innovation and standardization in the market. By working closely with tax authorities and industry regulators, market players can stay abreast of regulatory changes, compliance requirements, and best practices in tax management. These partnerships also help in building trust and credibility among customers, showcasing a commitment to sustainable tax solutions that align with regulatory expectations.

Overall, the Middle East and Africa Tax IT Software market is experiencing a transformative phase driven by technological advancements, changing customer needs, and regulatory dynamics. Market players that can effectively harness emerging technologies, offer flexible and secure solutions, and collaborate with stakeholders are well-positioned to capitalize on the growing demand for innovative tax IT software in the region. The key to success lies in anticipating market trends, adapting to evolving customer requirements, and delivering value-driven solutions that enable organizations to optimize their tax processes and achieve long-term compliance goals.The Middle East and Africa Tax IT Software market is witnessing a shift towards the integration of advanced technologies such as artificial intelligence (AI) and machine learning to enhance the efficiency and effectiveness of tax operations. The adoption of AI and machine learning capabilities allows for more streamlined data processing, predictive analytics for tax planning, and improved compliance management. This trend signifies a move towards more intelligent and automated tax IT solutions that can offer organizations a competitive edge in managing their tax obligations.

Another significant aspect shaping the market is the increasing demand for customizable and scalable tax IT software solutions tailored to the specific requirements of businesses in the region. As regulatory landscapes evolve, organizations are seeking flexible software that can adapt to changing compliance needs while ensuring seamless tax operations. Market players are responding by offering modular solutions that can be personalized to cater to the unique needs of various businesses, thus enabling organizations to future-proof their tax processes and remain compliant in a rapidly changing environment.

Furthermore, the focus on data security and privacy is driving innovation in tax IT software development in the Middle East and Africa market. With the growing concerns surrounding cybersecurity and data breaches, organizations are prioritizing solutions that guarantee robust security measures to protect sensitive tax data. Market players are investing in encryption technologies, secure cloud infrastructure, and compliance certifications to instill trust and confidence in their software's ability to safeguard critical information. Security and compliance have become vital differentiators for companies aiming to establish a competitive edge in the tax IT software market.

Collaborations and partnerships between tax IT software providers and government entities are also playing a pivotal role in fostering innovation and standardization in the market. By engaging with tax authorities and industry regulators, market players can stay updated on regulatory changes, compliance standards, and best practices in tax management. These strategic partnerships not only facilitate knowledge sharing but also demonstrate a commitment to delivering sustainable tax solutions that align with regulatory expectations and industry standards, ultimately building credibility and trust among customers.

In conclusion, the Middle East and Africa Tax IT Software market is undergoing a transformative phase characterized by the adoption of advanced technologies, the demand for customizable solutions, heightened emphasis on data security, and collaborative efforts to drive innovation and standardization. Market players that can successfully leverage emerging technologies, offer adaptable and secure solutions, and engage in fruitful partnerships with relevant stakeholders are well-positioned to capitalize on the increasing need for innovative tax IT software solutions in the region. Anticipating market trends, adapting to evolving customer demands, and delivering value-centric offerings will be essential for organizations looking to optimize their tax processes and achieve long-term compliance objectives in the dynamic Middle East and Africa market landscape.

The Middle East and Africa Tax IT Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-tax-it-software-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Influence of this Market:

- Comprehensive assessment of all opportunities and risk in this Middle East and Africa Tax IT Software Market

- This Market recent innovations and major events

- Detailed study of business strategies for growth of the this Market-leading players

- Conclusive study about the growth plot of the Middle East and Africa Tax IT Software Market for forthcoming years

- In-depth understanding of this Middle East and Africa Tax IT Software Market particular drivers, constraints and major micro markets

- Favourable impression inside vital technological and market latest trends striking this Market

- To provide historical and forecast revenue of the market segments and sub-segments with respect to four main geographies and their countries- North America, Europe, Asia, and Rest of the World (ROW)

- To provide country level analysis of the market with respect to the current market size and future prospective

Browse More Reports:

Global Hospice Market

Global Transfusion Bottle Market

Global Enzyme-Linked Immunosorbent Assay (ELISA) Tests Market

Global Train Ceiling Modules Market

Global Cloud Radio Access Network Market

Global Processor IP Market

Asia-Pacific Smoke Detector Market

Europe Long Chain Polyamide Market

Global Vehicle Emission Testers Market

Global Fish Protein Hydrolysate Market

Global Toothpaste Flavors Market

Global Flat Panel Displays Market

North America Automotive Sensor and Camera Technologies Market

Asia-Pacific Colour Concentrates Market

Global Scrambled Egg Mix Market

Global Ethylene Acrylic Acid (EAA) Market

Global Calcineurin Inhibitors Market

Global Dimethylformamide Market

Asia-Pacific Superalloys Market

Global Miticides Market

Global Swimming Pool Alarm Market

Global Eco-Friendly Labels Market

Global Smart Aquaculture Market

Global Ophthalmic Ultrasound Devices Market

Global Botanical Skin Care Ingredients Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com